How to Deposit Safely into Your Account A Comprehensive Guide -2102417232

How to Deposit Safely into Your Account: A Comprehensive Guide

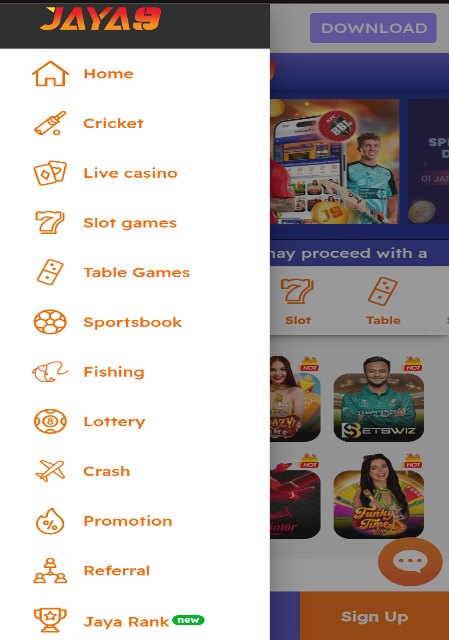

Depositing money into your online account should be a straightforward process, but with the rise of cybercrime and financial fraud, ensuring the safety of your deposits is more critical than ever. In this guide, we’ll explore various methods of safe deposits, useful tips, and how to enhance your financial security when transacting online. Additionally, using referral codes like How to Deposit Safely into Jaya9 Casino jaya9 voucher code free can often provide financial benefits while ensuring a secure deposit environment.

1. Understand the Deposit Methods Available

Before you can deposit safely, it’s essential to understand the various methods available. Some of the common deposit methods include:

- Credit/Debit Cards: Using a credit or debit card is one of the most common ways to make deposits. Ensure that the website you’re using is secure (look for HTTPS in the URL).

- E-Wallets: Services like PayPal, Skrill, and Neteller provide secure alternatives that often include buyer protection services.

- Bank Transfers: This method is considered one of the safest but may take longer to process.

- Cryptocurrency: Some platforms accept cryptocurrencies. While they might offer anonymity, be cautious as the market can be volatile.

2. Choose a Reputable Platform

Selecting a trustworthy platform is critical to ensuring your deposits are safe. Before depositing, consider the following:

- Licensing: Verify that the platform is licensed and regulated by a recognized authority.

- Reviews and Reputation: Research user reviews and ratings to gauge the platform’s reliability.

- Security Measures: Check for standard security features such as SSL encryption and two-factor authentication.

3. Secure Your Personal Information

To keep your deposits safe, safeguarding your personal information is key. Follow these guidelines:

- Strong Passwords: Create complex passwords that include letters, numbers, and symbols. Avoid using easily guessable passwords.

- Two-Factor Authentication: Enable two-factor authentication (2FA) on your account for an added layer of security.

- Beware of Phishing: Always double-check the URLs and emails you receive to avoid falling prey to phishing scams.

4. Understand Fees and Charges

Before making a deposit, familiarize yourself with any fees that may apply. Some platforms charge:

- Deposit Fees: Check if there are any service fees associated with your deposit method.

- Withdrawal Fees: Some platforms charge for transferring funds back to your bank account.

- Currency Conversion Fees: If you’re using a different currency, be aware of conversion fees that can affect the total amount.

5. Keep Track of Your Transactions

Always maintain a record of your transactions. Keeping track can help you catch any unauthorized activity early. Here’s what to do:

- Regular Monitoring: Regularly check your account statements and transaction history for discrepancies.

- Transaction Alerts: Enable notifications for any activities on your account to stay updated in real-time.

6. Stay Informed About Fraud Trends

The online landscape is constantly changing, with new scams emerging regularly. Stay informed by:

- Subscribing to Security News: Follow cybersecurity blogs and news to learn about the latest threats.

- Participating in Online Forums: Engage in communities where users share experiences and tips on avoiding fraud.

Conclusion

Depositing safely into your online account doesn’t have to be a daunting process. By understanding your options, choosing reputable platforms, securing your personal information, and monitoring your transactions, you can create a safe online finance environment. Always stay updated on the latest security practices and trends to maintain your financial security. Remember, your vigilance and informed actions are your best defense against fraud.