Project Finance Vs Corporate Finance: Key Variations Dr Hemant Avhad, Phd Hc Posted On The Topic

Outdoors of LBOs, this Exit Value or Terminal Value concept is extensively used in other company finance analyses, such as the DCF mannequin. So, the asset is “isolated” from the relaxation of the company, and the lenders can not seize other property if one thing goes wrong with the one specific asset they’ve funded. Subsequently, you’ll probably need to give consideration to high-profile assets that operate more like regular corporations, similar to large airports – or research funds or large firms in the sector.

Distinction Between Corporate Finance And Project Finance

Think About a toll-road concession, where the federal government grants the rights for 30 years to a private entity for operating the toll road. Subsequently, it’s crucial that the cashflows throughout that 30 year concession can repay the loan principal and curiosity, AND adequately compensate the entity. The lenders to the SPV don’t have any claim on the assets of the company entity that is sponsoring the project. The said information is neither owned by BFL nor it is to the unique data of BFL.

Investments

Subsequently, startups could discover company finance more appropriate until they are endeavor a sizable, standalone project. Companies use two different financial approaches–Project Finance vs Corporate Finance. Corporate finance deals with the general financial activities of a company. Project financing is simply one methodology to raise funds for particular ventures or undertakings. The function of corporate finance is to develop an optimum capital structure, handle cash flows, and make investment decisions to maximise shareholder value.

Understanding the variations between company and project finance is crucial in making knowledgeable monetary choices. It permits people and organizations to determine which approach is most fitted for his or her wants and targets. In company finance, decision-making primarily entails the administration and board of an organization. They are answerable for making financial selections that align with the company’s objectives and strategies. These decisions encompass areas such as investment choices, financing selections, and dividend insurance policies. One of the key defining options of project finance is its use of impartial entities fashioned solely to execute and function the project.

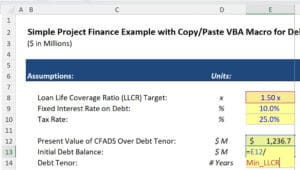

Company finance plays an important position within the success and progress of an organization. By managing the monetary actions, it ensures the availability of funds for varied operations, funding alternatives, and strategic initiatives. The major objective of company finance is to maximise the value of the company by making sound monetary decisions and optimizing the utilization of out there resources. Project Finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project somewhat than the stability sheets of the project sponsors.

Importance Of Understanding These Variations In Making Informed Monetary Selections

- Company financing is used when an entity is being established or when it pursues growth.

- Project finance is typically used for large-scale, specific projects like infrastructure or industrial ventures, which usually require important assets and money flows.

- Normally project finance is employed in large-scale infrastructure or growth initiatives, and the property of which produce money flows serve as collateral.

- In project finance, monetary establishments can’t see your balance sheet upfront in a project.

- This means the danger is contained throughout the project’s assets and money flows.

Then if you’d like, you can begin your own finance consulting firm where you would be serving to each events (lenders and borrowers) to get the desired outcomes. All you need to do is have the practical experience to get the hold of them. Both you probably can work as a financier for a bank or arrange the finance for the project. The traders take a look at the stability sheet of the corporate earlier than they make investments. As the risk is decrease and the fee is given from the money move (principal plus interest), the returns are normally lesser.

This article will concentrate on careers and recruiting, while the accompanying YouTube video will talk about the technical/modeling features in more element. With the craze over renewable energy and infrastructure over the past few years, we’ve received increasingly more questions about Project Finance vs. Corporate Finance. First, there could be voting rights after which management might classify equity possession (common vs. preferred).

Corporate finance and project finance are each financing fashions which handle the financial needs of an enterprise, company, or some other entity. In this part, we’ll explore the differences between company finance and project finance. Understanding these variations is essential for professionals within the finance trade or anybody involved in the field. On the opposite hand, Project Finance is usually used to fund specific, large-scale projects, with the money flows generated by the project itself getting used to repay investors. Nigeria and Africa need what you’re creating, and the best financing can help https://www.personal-accounting.org/ make it occur.

Usually, there may be numerous equity buyers who spend money on the project as sponsors and typically these loans are non-recourse loans (secured loans) which are given in opposition to project property. The loans are paid fully from the project cash flow, and if the events default to pay back the mortgage, then the project properties are being seized. Project finance is an important financing technique designed particularly for large-scale tasks. It differs from company finance, which focuses on the general monetary health of an entire firm. In project finance, the major focus is on particular person projects and their viability. Project finance is usually preferred over corporate finance for giant, capital-intensive initiatives that could be individually identified as a standalone entity.

In the case of companies that run initiatives normally seek the help of project financier when they’re three years or little much less in the operation. The above description is just an example, and there are lots of avenues of corporate finance, which we will focus on in later sections. Related to the primary risk, the second kind of threat refers to the lender being paid the amount it loaned to the borrower. In substance, design finance is more project finance vs corporate finance technical and focused on a single design, whereas industrial finance addresses the general fiscal health and technique of a enterprise. Obtain the Bajaj Finserv App today and experience the convenience of managing your funds on one app.